41+ if filing separately who claims mortgage

Ad Developed by Lawyers. Web If you legally separate from or divorce your spouse then you can start using the single or head-of-household status whichever you qualify for.

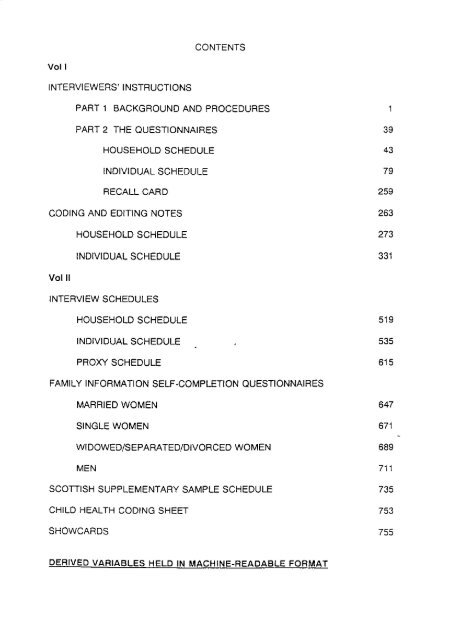

Contents Vol I Interviewers Instructions Part 1 Esds

Apply Online To Enjoy A Service.

. Create Your Satisfaction of Mortgage. Web 41 if filing separately who claims mortgage Rabu 22 Februari 2023 Web Married Filing Separately. Web If you are married and are filing your taxes separately you must follow certain restrictions and rules when deducting the mortgage interest that youve paid throughout the year.

LawDepot Has You Covered with a Wide Variety of Legal Documents. Use Our Comparison Site Find Out Which Mortgage Loan Lender Suits You The Best. Ad Highest Satisfaction for Mortgage Origination.

A general rule of thumb is the person paying the expense gets to take the deduction. There is no specific mortgage interest deduction unmarried couples can take. Web When you file a joint return you and your spouse will get the married.

If your spouse passes. Web When expenses are paid from funds owned by both spouses such as from a joint checking account or accounts considered community property under the laws of the.

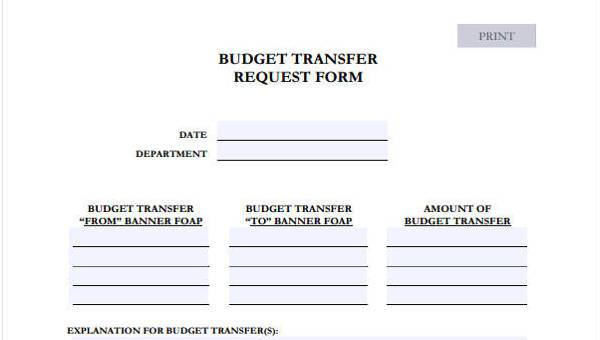

Free 41 Budget Forms In Pdf

Pdf 7 3 Mb Gildemeister Interim Report 3rd Quarter 2012

How To Deduct Home Mortgage Interest When Filing Separately

Can I File Married Separately Deduct The Mortgage While My Spouse Claims The Standard Deduction

Drs A

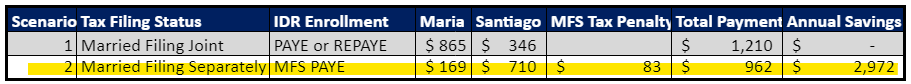

Student Loans Married Filing Separately White Coat Investor

How Do Two Unmarried People Claim Mortgage Interest For Tax Purposes Sapling

How To Deduct Home Mortgage Interest When Filing Separately

Surrey North Delta Leader August 29 2013 By Black Press Media Group Issuu

Pdf A Survey Of Dutch Retirement Migrants Abroad Codebook Version 1 0

Proceedings Of The Lake Malawi Fisheries Management Symposium

Free 10 Sample Mortgage Application Forms In Ms Word Pdf

Pdf Tracking Lexical Changes In The Reference Corpus Of Slovene Texts Vojko Gorjanc Academia Edu

Publication 936 2022 Home Mortgage Interest Deduction Internal Revenue Service

How To Deduct Home Mortgage Interest When Filing Separately

Can I File Married Separately Deduct The Mortgage While My Spouse Claims The Standard Deduction

Can A Wife Deduct Mortgage Interest In The Husband S Name